https://www.onlineed.com/catalog/182/Oregon-2-Hour-NMLS-CE

2 Hour OR SAFE: Oregon Mortgage Continuing Education

NMLS Course ID: 17522

NMLS Sponsor ID: 1400327

Credit Hours Provided: 2

Category: CE Elective

This course will cover several fundamental state regulations that Oregon mortgage loan originators must be familiar with. Being familiar with important laws in Oregon's residential mortgage loan industry will ensure that mortgage loan originators are compliant with the state's expectations of MLO behavior.

This course will cover several fundamental state regulations that Oregon mortgage loan originators must be familiar with. Being familiar with important laws in Oregon's residential mortgage loan industry will ensure that mortgage loan originators are compliant with the state's expectations of MLO behavior.

This five-module course starts out with a description of the Department of Consumer and Business Services (DCBS) and its Division of Financial Regulations (DFR). We'll then review financial statements, reporting changes to the DCBS, and MLO restrictions on working for a single entity in the second module of the course. The third module covers consumer disclosures in certain residential mortgage transactions, handling client trust funds, and regulations with advertising mortgage products. The fourth module covers various prohibited acts that licensees cannot participate in during the course of business, and the fifth module explains the DCBS investigation process.

Topics and Learning Objectives

This mortgage loan originator renewal license course is broken down into several learning topics. At the end of the course a 15-question final exam will be given. The topics included in this course are:

- Module 1: Overview of the DCBS and DFR

- Module 2: Oregon Licensing Definitions and Requirements

- Module 3: Disclosures, Limitations, Client Funds, and Advertising

- Module 4: Prohibited Acts

- Module 5: DCBS Investigations

- Final Exam

Total study time: 2 credit hours (100 minutes)

Module 1: Overview of the DCBS and DFR

The Oregon Division of Financial Regulation (DFR) is tasked with authorizing those who are working in the mortgage industry. The DFR is just one of several state agencies under the Department of Consumer and Business Services (DCBS). In this module we will review both agencies.

Module 2: Oregon Licensing Definitions and Requirements

In this module we'll go over general loan and licensing regulations. You'll review the licensing requirements for MLOs, mortgage bankers, mortgage brokers, and mortgage lenders, and understand when an individual is exempt from obtain a mortgage loan originator's license. We'll also go over financial records and reporting changes to licensee information to the DCBS.

Module 3: Disclosures, Limitations, Client Funds, and Advertising

Several disclosures are required to be given to consumers who are involved in a mortgage transaction. In this module we'll review consumer protections relating to certain types of residential mortgage loans. We'll also go over the licensee's responsibilities when accepting funds to be held in trust for the benefit of the borrower. We will also go over proper mortgage advertising practices.

Module 4: Prohibited Acts

In this module we'll review the various acts that licensees are prohibited from participating in as defined by Oregon law.

Module 5: DCBS Investigations

The Director of the Department of Consumer and Business Services has the authority to investigate potential Oregon law violations against mortgage licensees, invoke civil penalties and fines for discovered violations, and even order license suspension, revocation, or cease and desist orders. This module will review the investigation process available to the DCBS and possible sanctions against licensees for license violations.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

- Login into NMLS

- Click on the Composite View tab.

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students until midnight on December 31st, 2025

Learn More

Key Features

Online Course

Online Audio

Printable Certificate

PDF & EPUB eBook

Package Summary

| Price: |

$34.50 (USD)

+ $3.00 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 2 |

| State: | Oregon |

| Category: | Vocational Training > Mortgage > Continuing Education > Oregon > CE Elective |

| Purpose: | 2 hour state-specific online continuing education course for Oregon mortgage loan originators. |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

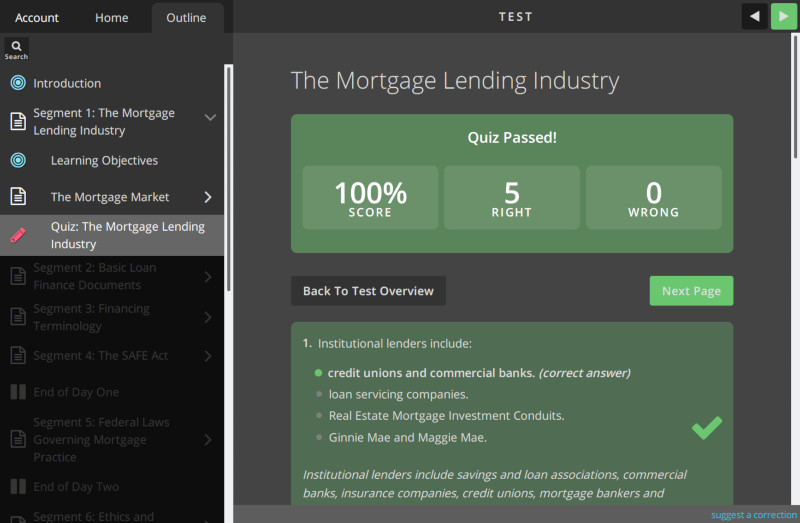

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

Oregon Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.