https://www.onlineed.com/catalog/1161/Massachusetts-Mortgage-Pre-License-Education

Massachusetts Mortgage Pre-License Education

Complete education to get a mortgage loan originator license with the Massachusetts DOB. Includes exam prep.

$315.00 | 23 Hours

+ $34.50 NMLS Credit Banking Fee

This mortgage pre-license course package contains all of the NMLS-required education you need to become licensed as a Massachusetts mortgage loan originator under the Massachusetts Division of Banks (DOB). This package includes:

-

20 Hour SAFE Comprehensive: Mortgage Loan Originator Prelicensure Course - This required course teaches you the basics about what mortgage loans are, discusses federal laws, ethics, mortgage types, how to fill out a mortgage application, and closing procedures. This course is in "online instructor-led" format. It begins and ends on a fixed schedule that you choose. The course includes opportunities to ask questions and get feedback from your instructor. There will also be an optional live weekly review session with your instructor via online webinar. This instructional portion of this course occurs in the first 4 days, with new sections being available each day. Each chapter features a Question & Answer page to submit questions and get feedback from the instructor. Students may take the final exam at any point starting on day 4 of the class after the instructional portion is completed.

-

3 Hour MA SAFE: Massachusetts Mortgage Lending Laws (NMLS ID 12105) - This online self-study DOB-specific course will cover the specific Commonwealth of Massachusetts licensing requirements and the additional MA mortgage lending laws that must be followed.

-

Test Prep Course - This optional, self-paced exam-cram course helps you study for the licensing exam after your required courses are completed. It covers all of the topics in the 20-hour pre-license course with additioanl review quiz questions. At the end is an "exam simulator" based on the same requirements as the licensing exam.

Frequently Asked Questions

What is an "Online Instructor-Led" course?

Students progress through a class under the guidance of an instructor. Classes will begin on a fixed date. Each day, students will work through online course material, take review quizzes, view review videos, and optionally participate in Question & Answer forums. The instructor will hold an optional weekly review session via live webinar, usually held on Fridays. This is a chance to review course material, ask additional questions, and prepare for the licensing exam.

How long does the 20-hour class take?

The instructor will guide the class for the first 4 days, after which students may access the final exam. Students must complete 20 hours of study time and all course material. Courses MAY be completed on the 4th day, but MUST be completed by the end of the class. Courses not completed before expiration are marked as failed.

Is attending the weekly review webinar required?

No, but highly recommended. It is your opportunity to get questions answered from your instructor in a live setting with fellow students.

How fast can I complete the 20-hour course?

This course runs on a fixed schedule that you choose at registration. You must complete the course within the schedule. Completion credits will be reported after the class has ended.

Can I get my course extended if I need more time?

No. The NMLS requires all instructor-led courses to be completed within the chosen schedule.

Learn More

Key Features

Online Materials

Includes Video

Online Audio

Optional Q&A Webinar

State Component

Printable Certificate

PDF & EPUB eBook

Practice Tests

Test Simulator

Online Flashcards

Package Summary

| Price: |

$315.00 (USD)

+ $34.50 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 23 |

| State: | Massachusetts |

| Category: | Vocational Training > Mortgage > License Training > Massachusetts |

| Purpose: | Complete education to get a mortgage loan originator license with the Massachusetts DOB. Includes exam prep. |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Class Calendar

December 29 (14 days)

December 29 (7 days)

December 30 (7 days)

December 30 (14 days)

December 31 (7 days)

December 31 (14 days)

January 1 (14 days)

January 1 (7 days)

January 2 (14 days)

January 2 (7 days)

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

Massachusetts Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.

Courses Included In This Package:

3 Hour MA SAFE: Massachusetts Mortgage Lending Laws

NMLS Course ID: 12105

NMLS Sponsor ID: 1400327

Credit Hours Provided: 3

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Massachusetts under the Massachusetts Division of Banks (DOB). This 3-hour course covers Massachusetts specific rules and regulations, and is required as part of the 20 hours of prelicense education needed to become a Massachusetts-licensed mortgage loan originator.

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Massachusetts under the Massachusetts Division of Banks (DOB). This 3-hour course covers Massachusetts specific rules and regulations, and is required as part of the 20 hours of prelicense education needed to become a Massachusetts-licensed mortgage loan originator.

Topics and Learning Objectives

This course consists of five modules and a final exam:

- The Licensing of Mortgage Loan Originators, Brokers, and Lenders

- License Requirements and Regulations

- Late Payment Limits and High-Cost Mortgage Fee Regulations

- Licensee Conduct and Examinations

- Licensee Fair Lending Evaluations, and the Community Reinvestment Act

- Final Exam

Total study time: 3 clock hours

Module 1: The Licensing of Mortgage Loan Originators, Brokers, and Lenders

The Division of Banks must first authorize a person the appropriate license before they can participate in mortgage loan origination activities. This chapter explains the DOB requirements for obtaining a mortgage loan originator license, a mortgage broker license, and a mortgage lender license. We'll also cover the annual responsibilities for maintaining the authority granted by the DOB.

Module 2: License Requirements and Regulations

Now that a license has been granted, a licensee has many recordkeeping requirements to comply with to ensure that they meet the minimum requirements for licensure. In this chapter, we'll cover how to properly maintain books and records, manage client funds accounts, and publish clear advertisements. After that, we'll go over reverse mortgage regulations that are specific to Massachusetts, and the importance of ensuring a mortgage refinance is in the borrower's best interests.

Module 3: Late Payment Limits and High-Cost Mortgage Fee Regulations

Mortgage regulations also protect borrowers from excessive fees. This chapter outlines the limitations on charging borrowers penalties for submitting late payments. We'll also cover fee restrictions and disclosure requirements when working with a high-cost mortgage loan.

Module 4: Licensee Conduct and Examinations

Improper licensee conduct can result in lost of DOB authorization. We'll now go through various prohibited acts and practices that may result in loss of license. We'll also explain how the state attorney general and DOB Commissioner can bring actions against licensees, including fines, license suspension, and revocation.

Module 5: Licensee Fair Lending Evaluations, and the Community Reinvestment Act

In this last chapter we'll outline how the DOB reviews a mortgage lender's records to ensure that the lending requirements of the community are being met in a fair and undiscriminatory way. This review includes a Mortgage Lender Community Investment (MLCI) evaluation. We will identify the steps of a MLCI exam and the possible ratings that a lender can be assigned after the DOB's completion of the lending records.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

20 Hour SAFE Comprehensive - Mortgage Loan Originator Pre-Licensure Education Course

NMLS Course ID: 6121

NMLS Sponsor ID: 1400327

Credit Hours Provided: 20

This 20-hour mortgage loan originator pre-license course will teach you the various aspects of the mortgage lending industry such as loan finance documents, the laws that must be followed, the importance of ethical conduct, how to watch out for fraud and other nefarious acts, how to complete a loan application and the process for loan approval, and various different loan programs that are available to consumers.

Some states require state-specific prelicense education in addition to the standard course. Please check with your state regulatory agency, the NMLS, or contact us to verify if the jurisdiction you are becoming licensed under requires additional state-specific training.

Course Content

This course is divided into 12 chapters:

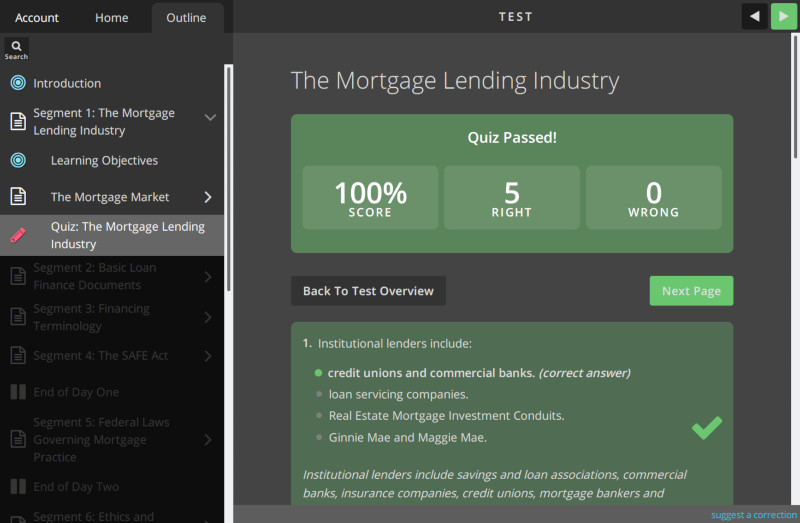

- Segment 1: The Mortgage Lending Industry

- Segment 2: Basic Loan Finance Documents

- Segment 3: Financing Terminology

- Segment 4: The SAFE Act

- Segment 5: Federal Laws Governing Mortgage Practice

- Segment 6: Ethics and Consumer Protection

- Segment 7: Fraud and Money Laundering

- Segment 8: The Mortgage Loan Application

- Segment 9: Processing and Underwriting

- Segment 10: Closing

- Segment 11: Financial Calculations

- Segment 12: Specific Loan Programs

The instructional portion of this course will occur over the first 4 days. As required by the Nationwide Multistate Licensing System (NMLS), sections of the course will unlock as the class moves together through the course material. Your course will remain available until the end of the session you selected at the time of registration. Use this time to study for the final exam.

Each chapter will include a Question & Answer bulletin board to allow students ask questions of the instructor and get feedback. Quizzes are given throughout the course. Each day includes review videos by the instructor to highlight important concepts.

The online final exam will be presented at the end of the course. The final exam is not timed, contains 25 multiple choice questions, and requires a 70% or higher passing score. Students can take multiple attempts at passing the final exam, with each attempt containing a new set of test questions. The final exam must be completed before the end of the class session to receive credit for passing the course.

NMLS functional specifications define that a 20-hour mortgage loan originator prelicense courses MUST be completed within 14 days of the course session start date. Students who do not pass the final exam before the enrollment period expires will be marked as failing the course. Refunds will not be issued for failed courses. Extensions to lengthen the enrollment period are NOT available. Students who fail the course can enroll for a new course session and must start from the beginning.

After successfully passing the final exam, OnlineEd will notify the Nationwide Multistate Licensing System (NMLS) that the mortgage loan originator pre-education has been completed by the student. It is OnlineEd policy to have credit uploaded to the NMLS by the end of the following business day.

The student will have a printable course completion certificate available after passing the course final exam. The certificate is for the student's personal records and is not confirmation that the NMLS has received the notification that the student has completed the course.

Special Live Session

Each class will have the opportunity to participate in a live webinar session with the instructor. It is a chance to review material from the course, study for the exam, and discuss the licensing process. This session is optional but highly encouraged.

Technical Requirements

This is an online, instructor-led mortgage loan originator pre-license course that contains online reading materials, audio presentations, and video presentations. Students will need to have a current internet browser and computer speakers. The instructor-led webinar sessions are presented using the Zoom conferencing platform. A webcam is NOT required. An audio bridge call-in number along with confirmation of the webinar session times will be emailed to students after registering for the live instructor session.

NMLS Unique ID is Required

You will need a NMLS Unique ID number in order for us to upload record of your course completion to the NMLS. If you already have an NMLS ID but don't remember what it is:

Login into NMLS

Click on the Composite View tab.

Click View Individual on the sub-header row.

The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center:

Learning Module Outline

Segment 1: The Mortgage Lending Industry

Total study time: 30 minutes

This segment will give you an overview of the mortgage lending industry. Students will learn about various types of lenders and the parties who are involved in the mortgage lending process.

Segment 2: Basic Loan Finance Documents

Total study time: 30 minutes

This segment will explain the various promissory notes that are available. Students will also learn the three main types of security instruments used in residential purchase transactions.

Segment 3: Financing Terminology

Total study time: 1 clock hour

There are many terms and words used within the mortgage industry that aren't a part of the everyday person's vocabulary. This segment will outline many common words and loans used in the lending industry.

Segment 4: The SAFE Act

Total study time: 1 clock hour

After the passage of the SAFE Act, a national registration system was created that allowed states to use a centralized system to supervise the licensing of individuals and companies. This segment will explain the SAFE Act and its implications on the mortgage industry

Segment 5: Federal Laws Governing Mortgage Practice

Total study time: 4.5 clock hours

This segment will outline many of the important federal regulations and rules that students will need to comply with when working with borrowers on residential loan transactions.

Segment 6: Ethics and Consumer Protection

Total study time: 1 clock hour

Interacting with the public must always be done in an ethical manner. There are many courtesy standards that should be followed, as licensees are expected to protect the loan applicant's interests and not take an unfair advantage of an applicant in order to earn a commission.

Segment 7: Fraud and Money Laundering

Total study time: 1 clock hour

This segment will outline the ways in which loan fraud is used for illegal activities, the programs that companies are expected to create to detect fraud, and the various ways that criminals try to trick lenders (and mortgage loan originators) into financing their property purchases.

Segment 8: The Mortgage Loan Application

Total study time: 2.5 clock hours

This segment will outline both the standard loan application and the Loan Estimate disclosure. Students will also learn about credit scores and what to look out for when working with documents submitted by applicants to support their personal financial obligations.

Segment 9: Processing and Underwriting

Total study time: 30 minutes

Appraisals are often used to confirm that the property being used as collateral for the loan is adequate in case of borrower default. If the lender has to take the property and sell it, the property should be worth enough money for the lender to recoup its financial loss.

Segment 10: Closing

Total study time: 2 clock hours

In this segment students will learn about the RESPA Closing Disclosure. This form is in conjunction with the earlier Loan Estimate and discloses the final details of the approved loan to the borrower.

Segment 11: Financial Calculations

Total study time: 30 minutes

Financial transactions naturally involve a lot of math calculations; the amount to be repaid monthly, how much interest a loan will accrue during its term, and so on. Students will also need to be able to take the income and debt values supplied by the loan applicant to determine if he or she will even meet the minimum qualifications for the loan being applied for.

Segment 12: Specific Loan Programs

Total study time: 2 clock hours

There are a variety of loan programs available for applicants to qualify for. This segment will give students an overview of a variety of loan programs that borrowers can apply for.

This course will remain available to students for 14 days after enrollment.

Mortgage Loan Originator Prelicense Exam Prep

This course is a study guide to help licensee applicants prepare for the mortgage loan originator licensing exam. Each chapter of this course contains a study exam of test questions that students can use to help retain the information taught during the 20-hour national prelicense course.

The topics covered in this course are:

- Segment 1: The Mortgage Lending Industry

- Segment 2: Basic Loan Finance Documents

- Segment 3: Loan Types and Terminology

- Segment 4: The SAFE Act

- Segment 5: Federal Laws Governing Mortgage Practice

- Segment 6: Ethics and Consumer Protection

- Segment 7: Fraud and Money Laundering

- Segment 8: The Mortgage Loan Application

- Segment 9: Processing and Underwriting

- Segment 10: Closing

- Segment 11: Financial Calculations

- Segment 12: Specific Loan Programs

Each chapter's study exam presents a large number of questions for students to test themselves on. As each question is graded as correct, the number of questions available in the chapter's prep test will be reduced until the student has correctly answered all of the questions in the chapter. Progress can be reset at any time if the student wants to be presented with all of the chapter's test questions again.

At the end of the course is a test based on the same timing requirements as the NMLS MLO licensing exam. The test will present 125 questions in a random order. Students will have 190 minutes to achieve a 75% or higher passing score. This sample exam may be attempted as many times as desired.

Completing this module is not necessary for earning credit towards completing the prelicense education requirements to earn a mortgage loan originator license.

This course will remain available to students for 365 days after enrollment.