https://www.onlineed.com/catalog/737/20-Hour-Mortgage-License-Course-Deluxe

20 Hour SAFE Comprehensive - Mortgage Pre-License Course

20-hour National SAFE prelicense course for obtaining a mortgage loan originator license. Includes test-taking strategy video.

$249.00 | 20 Hours

+ $30.00 NMLS Credit Banking Fee

Looking to become a mortgage officer and originate loans? You are in the right place! This education package will give you everything you need to qualify to be a licensed loan officer in 25 states, plus additional help to pass the licensing exam.

Looking to become a mortgage officer and originate loans? You are in the right place! This education package will give you everything you need to qualify to be a licensed loan officer in 25 states, plus additional help to pass the licensing exam.

Who should get this package:

This 20-hour mortgage loan originator pre-license training package fulfills the basic NMLS requirements to become a mortgage loan originator in Alabama, Alaska, Arkansas, California (DRE), Delaware, Georgia, Guam, Illinois, Indiana (DFI), Iowa, Kansas, Kentucky, Louisiana, Maine, Minnesota, Missouri, North Dakota, Puerto Rico, South Dakota, Texas (OCCC), Utah, Virgin Islands, Virginia, Wisconsin, and Wyoming.

If you see your state in that list, this is the right education package for you! We made sure it includes everything you need including the NMLS required pre-license hours, exam-prep study material, flash cards, and a test simulator. We want you to pass the exam and succeed in your career, so we make all of our deluxe materials standard!

Don't see your state in that list?

Some states require state-specific education in addition to the standard 20-hour course.

Browse our course catalog to find the right pre-license package for your state.

Check the NMLS state-specific education chart to see what additional courses you may need.

This package includes:

-

20 Hour SAFE Comprehensive: Mortgage Loan Originator Prelicensure Course - This required course teaches you the basics about what mortgage loans are, discusses federal laws, ethics, mortgage types, how to fill out a mortgage application, and closing procedures. This course is in "online instructor-led" format. It begins and ends on a fixed schedule that you choose. The course includes opportunities to ask questions and get feedback from your instructor. There will also be an optional live weekly review session with your instructor via online webinar. This mortgage loan originator NMLS pre-licensing course is structured to be completed in a 4-day class. Each chapter features a Question & Answer page to submit questions and get feedback from the instructor. Students may take a final exam starting on day 4 of the class but may take up to 14 days to finish the class.

-

Test Prep Course - This optional, self-paced exam-cram course helps you study for the licensing exam after your required courses are completed. It reviews all of the topics in the 20-hour pre-license course using points to remember, video, and quiz questions. At the end is an "exam simulator" based on the same requirements as the licensing exam.

-

SPECIAL BONUS: Licensing Exam Test-Taking Strategy Video Course - A special feature you won't find anywhere else! This is a 2-hour coaching video that will present tips on how to pass the national mortgage loan originator licensing exam. Topics include how to schedule the exam, what to expect on arrival, test taking techniques, and review of the NMLS test content outline.

Frequently Asked Questions

What is an "Online Instructor-Led" course?

Students progress through a class under the guidance of an instructor. Classes will begin on a fixed date. Each day, students will work through online course material, take review quizzes, view review videos, and optionally participate in Question & Answer forums. The instructor will hold an optional weekly review session via live webinar, usually held on Fridays. This is a chance to review course material, ask additional questions, and prepare for the licensing exam.

How long does the 20-hour class take?

The instructor will guide the class for the first 4 days, after which students may access the final exam. All students must complete the required 20 study hours in the course. Courses MAY be completed on the 4th day, but MUST be completed with 14 days. Courses not completed in 14 days are marked as failed.

Is attending the weekly review webinar required?

No, but highly recommended. It is your opportunity to get questions answered from your instructor in a live setting with fellow students.

How fast can I complete the 20-hour course?

4 days. The final exam becomes available at the end of the 4th day of class for students who have completed the required study time.

Can I get my course extended if I need more time?

No. The NMLS requires all instructor-led courses to be completed within 14 days.

Learn More

Key Features

Online Materials

Includes Video

Online Audio

Optional Q&A Webinar

Printable Certificate

PDF & EPUB eBook

Practice Tests

Test Simulator

Test-Taking Strategies

Online Flashcards

Mortgage 101 Bootcamp Add +$99.00

Package Summary

| Price: |

$249.00 (USD)

+ $30.00 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 20 |

| Category: | Vocational Training > Mortgage > License Training |

| Purpose: | 20-hour National SAFE prelicense course for obtaining a mortgage loan originator license. Includes test-taking strategy video. |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

Courses Included In This Package:

20 Hour SAFE Comprehensive - Mortgage Loan Originator Pre-Licensure Education Course

NMLS Course ID: 6121

NMLS Sponsor ID: 1400327

Credit Hours Provided: 20

This 20-hour mortgage loan originator pre-license course will teach you the various aspects of the mortgage lending industry such as loan finance documents, the laws that must be followed, the importance of ethical conduct, how to watch out for fraud and other nefarious acts, how to complete a loan application and the process for loan approval, and various different loan programs that are available to consumers.

Some states require state-specific prelicense education in addition to the standard course. Please check with your state regulatory agency, the NMLS, or contact us to verify if the jurisdiction you are becoming licensed under requires additional state-specific training.

Course Content

This course is divided into 12 chapters:

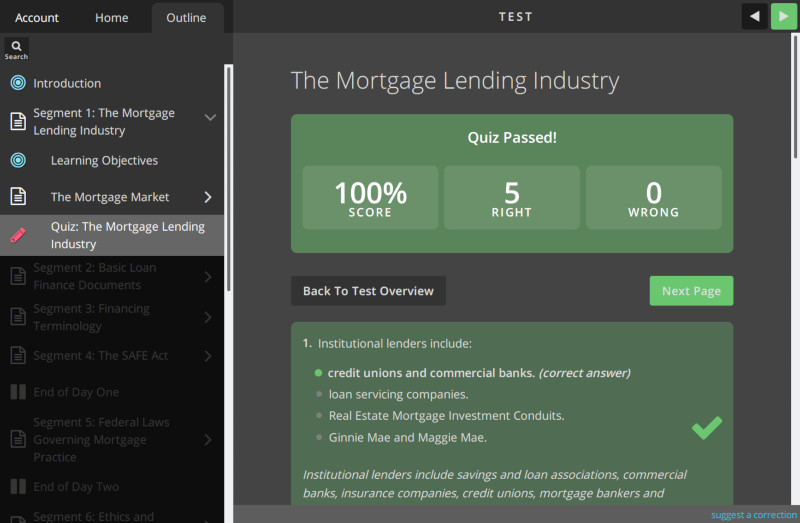

- Segment 1: The Mortgage Lending Industry

- Segment 2: Basic Loan Finance Documents

- Segment 3: Financing Terminology

- Segment 4: The SAFE Act

- Segment 5: Federal Laws Governing Mortgage Practice

- Segment 6: Ethics and Consumer Protection

- Segment 7: Fraud and Money Laundering

- Segment 8: The Mortgage Loan Application

- Segment 9: Processing and Underwriting

- Segment 10: Closing

- Segment 11: Financial Calculations

- Segment 12: Specific Loan Programs

This mortgage loan originator pre-license course is structured to be completed in a 4-day class. As required by the Nationwide Mortgage Licensing System (NMLS), sections of the course will unlock as the class moves together through the course material, ensuring that no student moves faster than the rest of the class.

Each chapter will include a Question & Answer bulletin board to allow students ask questions of the instructor and get feedback. Quizzes are given throughout the course. Each day includes review videos by the instructor to highlight important concepts.

The online final exam will be presented at the end of the course. The final exam is not timed, contains 25 multiple choice questions, and requires a 70% or higher passing score. Students can take multiple attempts at passing the final exam, with each attempt containing a new set of test questions. The final exam must be completed before the end of the 14-day class session to receive credit for passing the course.

NMLS functional specifications define that a 20-hour mortgage loan originator prelicense courses MUST be completed within 14 days of the course session start date. Students who do not pass the final exam before the enrollment period expires will be marked as failing the course. Refunds will not be issued for failed courses. Extensions to lengthen the 14-day enrollment period are NOT available. Students who fail the course can enroll for a new course session and must start from the beginning.

After successfully passing the final exam, OnlineEd will notify the Nationwide Mortgage Licensing System (NMLS) that the mortgage loan originator pre-eduction has been completed by the student. It is OnlineEd policy to have credit uploaded to the NMLS by the end of the following business day.

The student will have a printable course completion certificate available after passing the course final exam. The certificate is for the student's personal records and is not confirmation that the NMLS has received the notification that the student has completed the course.

Special Live Session

Each class will have the opportunity to participate in a live webinar session with the instructor. It is a chance to review material from the course, study for the exam, and discuss the licensing process. This session is optional but highly encouraged.

Technical Requirements

This is an online, instructor-led mortgage loan originator pre-license course that contains online reading materials, audio presentations, and video presentations. Students will need to have a current internet browser and computer speakers. The instructor-led webinar sessions are presented using the Zoom conferencing platform. A webcam is NOT required. An audio bridge call-in number along with confirmation of the webinar session times will be emailed to students after registering for the live instructor session.

NMLS Unique ID is Required

You will need a NMLS Unique ID number in order for us to upload record of your course completion to the NMLS. If you already have an NMLS ID but don't remember what it is:

Login into NMLS

Click on the Composite View tab.

Click View Individual on the sub-header row.

The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center:

Learning Module Outline

Segment 1: The Mortgage Lending Industry

Total study time: 30 minutes

This segment will give you an overview of the mortgage lending industry. Students will learn about various types of lenders and the parties who are involved in the mortgage lending process.

Segment 2: Basic Loan Finance Documents

Total study time: 30 minutes

This segment will explain the various promissory notes that are available. Students will also learn the three main types of security instruments used in residential purchase transactions.

Segment 3: Financing Terminology

Total study time: 1 clock hour

There are many terms and words used within the mortgage industry that aren't a part of the everyday person's vocabulary. This segment will outline many common words and loans used in the lending industry.

Segment 4: The SAFE Act

Total study time: 1 clock hour

After the passage of the SAFE Act, a national registration system was created that allowed states to use a centralized system to supervise the licensing of individuals and companies. This segment will explain the SAFE Act and its implications on the mortgage industry

Segment 5: Federal Laws Governing Mortgage Practice

Total study time: 4.5 clock hours

This segment will outline many of the important federal regulations and rules that students will need to comply with when working with borrowers on residential loan transactions.

Segment 6: Ethics and Consumer Protection

Total study time: 1 clock hour

Interacting with the public must always be done in an ethical manner. There are many courtesy standards that should be followed, as licensees are expected to protect the loan applicant's interests and not take an unfair advantage of an applicant in order to earn a commission.

Segment 7: Fraud and Money Laundering

Total study time: 1 clock hour

This segment will outline the ways in which loan fraud is used for illegal activities, the programs that companies are expected to create to detect fraud, and the various ways that criminals try to trick lenders (and mortgage loan originators) into financing their property purchases.

Segment 8: The Mortgage Loan Application

Total study time: 2.5 clock hours

This segment will outline both the standard loan application and the Loan Estimate disclosure. Students will also learn about credit scores and what to look out for when working with documents submitted by applicants to support their personal financial obligations.

Segment 9: Processing and Underwriting

Total study time: 30 minutes

Appraisals are often used to confirm that the property being used as collateral for the loan is adequate in case of borrower default. If the lender has to take the property and sell it, the property should be worth enough money for the lender to recoup its financial loss.

Segment 10: Closing

Total study time: 2 clock hours

In this segment students will learn about the CFPB's Closing Disclosure. This form is in conjunction with the earlier Loan Estimate and discloses the final details of the approved loan to the borrower.

Segment 11: Financial Calculations

Total study time: 30 minutes

Financial transactions naturally involve a lot of math calculations; the amount to be repaid monthly, how much interest a loan will accrue during its term, and so on. Students will also need to be able to take the income and debt values supplied by the loan applicant to determine if he or she will even meet the minimum qualifications for the loan being applied for.

Segment 12: Specific Loan Programs

Total study time: 2 clock hours

There are a variety of loan programs available for applicants to qualify for. This segment will give students an overview of a variety of loan programs that borrowers can apply for.

This course will remain available to students for 14 days after enrollment.

Mortgage Loan Originator Prelicense Exam Prep

This course is a study guide to help licensee applicants prepare for the mortgage loan originator licensing exam. Each chapter of this course contains a study exam of test questions that students can use to help retain the information taught during the 20-hour national prelicense course.

The topics covered in this course are:

- Segment 1: The Mortgage Lending Industry

- Segment 2: Basic Loan Finance Documents

- Segment 3: Loan Types and Terminology

- Segment 4: The SAFE Act

- Segment 5: Federal Laws Governing Mortgage Practice

- Segment 6: Ethics and Consumer Protection

- Segment 7: Fraud and Money Laundering

- Segment 8: The Mortgage Loan Application

- Segment 9: Processing and Underwriting

- Segment 10: Closing

- Segment 11: Financial Calculations

- Segment 12: Specific Loan Programs

Each chapter's study exam presents a large number of questions for students to test themselves on. As each question is graded as correct, the number of questions available in the chapter's prep test will be reduced until the student has correctly answered all of the questions in the chapter. Progress can be reset at any time if the student wants to be presented with all of the chapter's test questions again.

At the end of the course is a test based on the same timing requirements as the NMLS MLO licensing exam. The test will present 125 questions in a random order. Students will have 190 minutes to achieve a 75% or higher passing score. This sample exam may be attempted as many times as desired.

Completing this module is not necessary for earning credit towards completing the prelicense education requirements to earn a mortgage loan originator license.

This course will remain available to students for 365 days after enrollment.

NMLS Mortgage Licensing Exam Test-Taking Strategy Course

The NMLS Test-Prep Webinar will provide you with:

- information on how to schedule your NMLS examination,

- insight as to what you can expect upon arriving at the testing center,

- proven test-preparation and study strategies as well as test-taking techniques that work,

- instruction on how to effectively utilize the NMLS Test Content Outline,

- Eighteen (18) additional study sources,

- the opportunity to sign up for one-on-one, personalized test-prep tutoring.

This video course session will share proven exam-taking and study strategies with you that have assisted numerous test candidates build their confidence and pass this exam. Created and delivered by a seasoned mortgage professional, mortgage instructor, and trainer, this video class can increase your odds of knocking the NMLS national mortgage licensing examination out of the park on your first attempt. Think of this as an investment in yourself, your career, and your success. Can you really afford not to? Sign up today!

A live (webinar) version of this course is also available for registration. The live version allows you to interact with the course instructor in a Question & Answer session, covering topics you may need additional guidance in before taking your MLO license examination.

About Your Instructor

Rich Leffler is the President, CEO, and Senior Instructor of AxSellerated Development, LLC, a success coaching and mortgage consulting firm dedicated to assisting others achieve personal and professional success. In addition to being a charismatic, captivating, and sought-after personal success coach, instructor, NMLS exam tutor, and speaker, Rich is responsible for creating, coordinating, and executing training curriculums affording new mortgage loan originators and those considering a career in mortgage lending with the fundamental skills necessary to originate successfully and compliantly.

This course will remain available to students for 365 days after enrollment.